OSDC underwent significant change in 2023, including the appointment of a new Board President and Executive Director, as well as dramatic growth in our small business lending portfolio. We’re helping more businesses in more places in Ohio than ever before.

OSDC underwent significant change in 2023, including the appointment of a new Board President and Executive Director, as well as dramatic growth in our small business lending portfolio. We’re helping more businesses in more places in Ohio than ever before.

Insight from our diverse and creative borrowers is informing the new lending programs we’re building and the banking and economic development partnerships we’re establishing. It is their ingenuity and hope for the future that fuels our expansion and economic impact in the state.

On behalf of the OSDC Board of Directors and our amazing staff, thank you for giving us the opportunity to help small businesses across Ohio secure the financing they need to grow. We’re excited about what the next year will bring.

Chris Magill, OSDC Board President

Katie Kramer, OSDC Executive Director

HEART

HEART

Small businesses are the heart of everything we do. When they thrive, we thrive.

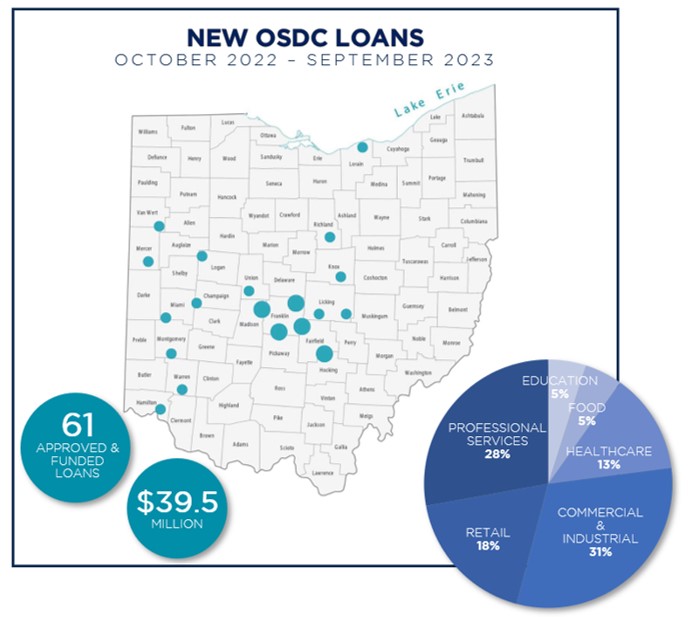

OSDC is proud to have directly helped 61 small businesses in Ohio achieve a loan approval or funding. Hundreds more were indirectly assisted through day-to-day interactions, portfolio management, and technical assistance to find the right financing solution.

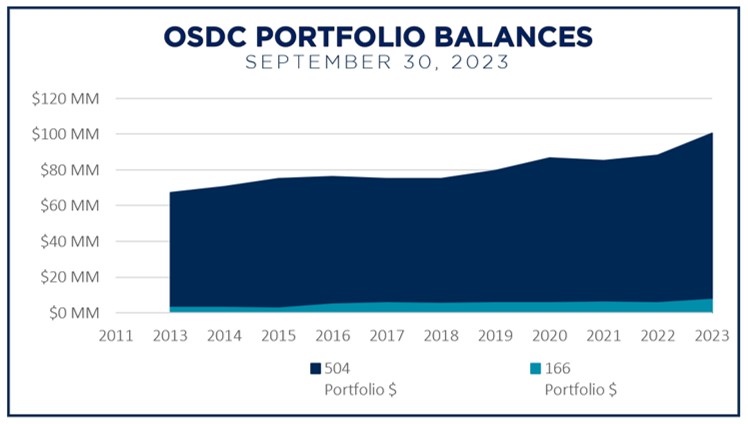

In fact, OSDC’s small business portfolio now stands at 295 loans spread across every region of Ohio and more than half of the counties. Our efforts have contributed approximately $105 million in lending and more than $380 million in public and private investment to Ohio’s economy.

IMPACT

IMPACT

Helping small businesses access capital means that we can positively impact the Ohio economy and the lives of our friends and neighbors.

OSDC offers two main loan programs to Ohio’s small businesses: the SBA 504 Loan Program and the Ohio Regional 166 Direct Loan Program. Both programs are designed to help businesses invest in real estate, property, equipment, and most importantly, growth.

PARTNER WITH OSDC

PARTNER WITH OSDC

Our partners are our lifeblood and give us the vitality we need to fulfill our mission.

OSDC had the opportunity to work with 37 different lending partners in 2023. For banking institutions seeking to overcome common lending challenges, OSDC is your strategic ally, providing solutions that benefit both lenders and small businesses.

Choose OSDC as your partner to simplify small business lending, enhance financial flexibility for businesses, and contribute to the growth of Ohio’s entrepreneurial community. Contact OSDC today to revolutionize your approach to supporting small businesses.

OSDC CAN HELP YOUR SMALL BUSINESS

We are your financial heartbeat.

With our mission-driven approach and proven track record, we stand ready to assist entrepreneurs in navigating the complexities of securing a loan. Whether you’re exploring the benefits of an SBA 504 Loan or considering the Ohio Regional 166 Direct Loan Program, OSDC is here to guide you. Wondering what it takes to get a business loan or seeking the best financing options for your startup? Look no further. Let us help you unlock the doors to growth and success. Discover the difference OSDC can make for your small business journey.

Visit Contact Us to speak to a loan officer today.