The SBA 504 is designed for small businesses that want to invest in expansion but still maintain cash for working capital. As such, it provides fixed, below-market interest rates with longer loan term options and lower down payment requirements.

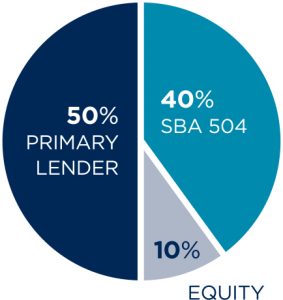

SBA 504 loans are provided in conjunction with a bank or other primary lender, financing up to 40% of the total cost of commercial real estate projects and equipment purchases. These features are ideal for a wide range of businesses, even if they already qualify for a conventional loan.

SBA 504 HIGHLIGHTS

- Loans up to $5 million ($5.5 million for manufacturing)

- Terms of 10, 20, or 25 years

- Low, fixed rate for entire term

- Debt refinance is eligible

- Funds can only be used for real estate and equipment

ELIGIBILITY REQUIREMENTS

- For-profit, operating businesses

- Average net income of $5 million or less and tangible net worth of $15 million or less

- For real estate projects, borrower’s business must occupy 51% of the building (60% for new construction)

WANT TO FIND OUT IF THE SBA 504 IS RIGHT FOR YOU?

Just contact us and we’ll run some numbers... even if you already qualify for a conventional loan, or are thinking about refinancing an existing one.